Preparing cash flow statements is a lot easier than you think! IAS 7 ‘Cash flow statements’ is an IFRS standard that governs and gives guidance on this primary statement. In part 1 of this post, I will share with you a guidance on preparing cash flow statements. And in part 2 (Step-by-step cash flows – Excel model), bonus! I will share with you free Excel Spreadsheet Model which you can use to prepare your IFRS compliant cash flow statement.

Just the way statement of equity is nothing but a table showing movements within equity, statement of cash flows is nothing but a table showing movements within cash [and its equivalents] during the accounting period.

What is cash and its equivalents (C&CE)?

IAS 7 (paragraph 6) defines cash as “cash on hand and demand [or current] deposits”. Cash equivalents are defined as “short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value”.

The term of cash equivalents should be less than 3 months. This is not 3 months from the balance sheet date, but total life/term of the contract or investment from the date of acquisition. Therefore, if you have a 6-month deposit with your bank, this would not be classified as a cash equivalent.

As long as the above definition is met, cash equivalents can include:

- Bank deposits

- Certificates of deposit (CDs)

- Money market instruments

- Corporate bonds

- Gilts and T-bonds

- Eurobonds

- Bank overdrafts [which are integral to your company’s cash management]

Even if you include your bank overdraft within your ‘cash and cash equivalents’ on your cash flow statements, you cannot normally include it within ‘cash and cash equivalents’ line on your balance sheet. On the balance sheet, the bank overdraft would be included within current liabilities. In the notes to financial statements, you would then state what items on your balance sheet form part of ‘cash and cash equivalents’ for the purposes of cash flow statement.

For an investment to be classified as cash equivalent, you should be able to withdraw the amounts at any time without paying significant penalties (such as early/premature withdrawal penalties).

Where your short-term deposit is with a party which exposes you to a significant credit risk (i.e. risk that counterparty fails to repay you), you cannot include this amount within cash equivalents. This is because the money would not be ‘readily convertible to know amounts of cash’.

Paragraph 7 of the standard specifically states that no equity investment can be classified as cash equivalent. This is because they normally have significant risk of changes in value.

Statement of cash flows

As I mentioned above, a statement of cash flows is a table showing and explaining the movement of your cash and cash equivalents during the year (i.e. reconciling opening with closing balance). This reconciliation should be broken down into cash flows from the following three categories:

- operating activities;

- investing activities; and

- financing activities.

To severely oversimplify it, a cash flow statement would look like this:

What is included in cash flows from operating activities?

IAS 7 paragraph 6 puts it: “the principal revenue-producing activities of the entity and other activities that are not investing or financing activities”.

Reading cash flows statements are easy! From the above, you should be able to tell that company generates $400k-$500k a year, which can be used for your investment and financing activities.

- If the monies generated from operating activities are positive (like in the example above), this means that your company can maintain its operating capability and even support any cash needed for investing activities (such as purchase of PP&E, investment in bonds) or financing activities (such as payment of dividends, repayment of borrowings).

- If, on the other hand, the monies from operating activities are negative, this means that your company may need support from cash flows from investing activities (such as dividend income from your investments, sale/disposal of investments) or financing activities (such as raising cash through borrowings or share issue) to support its operating capability.

Cash flows from operating activities can be reported either using direct or indirect method. This should not affect the total amounts reported under each heading (operating/investing/financing).

To give you an oversimplified version of both direct and indirect methods for operating activities, I will expand on my previous example:

Although, direct method above seems easier to prepare and read, it may actually require a separate cash-based accounting system. Otherwise, you could work it out by adjusting your operating profits for non-cash items and changes in your working capital.

From my experience, most companies opt for indirect method of preparing cash flow statements. This is because it’s actually easier to prepare and it reveals less information (because it shows net receipts/payments, rather than gross).

Investing activities

IAS 7 paragraph 6 defines investing activities as “acquisition and disposal of long-term assets and other investments not included in cash equivalents”. You will need to include the following cash flows in your investing activities:

- Payments for purchase of PP&E, intangible assets and investment properties

- Proceeds from sale of PP&E, intangible assets and investment properties

- Payments for purchase of equity (including investment associates) and debt (including related party loans)

- Proceeds from sale of equity and debt investments

- Dividends received from your investments

- Payments for acquisition of subsidiaries, net of cash acquired

- Proceeds from sale of subsidiaries, net of cash disposed

Financing activities

Paragraph 6 puts it as “activities that result in changes in the size and composition of the contributed equity and borrowings of the entity”. So, include:

- Proceeds from and repayment of borrowings (other than overdrafts which are included as part of cash equivalents)

- Proceeds from issuance of shares and other capital contributions

- Purchase and sale of treasury shares

- Acquisition of and proceeds from disposal of non-controlling interest in subsidiaries

- Dividends paid

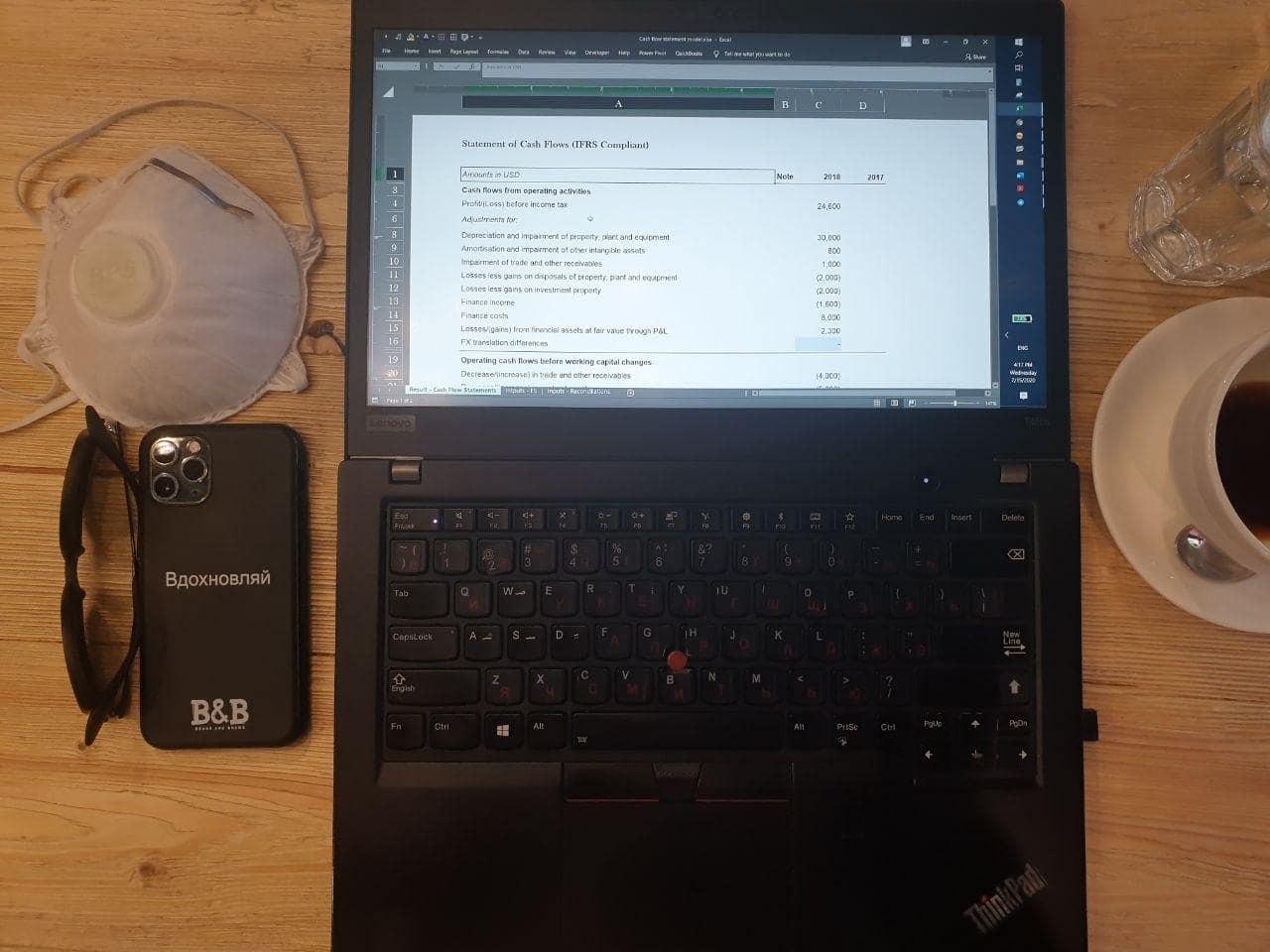

Excel cash flow statement model

In part 2 of this post (Step-by-step cash flows – Excel model), you can download your free Excel model, where I will give you guidance on how to use the model to easily prepare your IFRS compliant cash flow statements.

Yours,

JU