IAS 1 – Presentation of Financial Statements

In this post, I will tell you what IFRS financial statements look like, and in the next post (coming soon), I will help you prepare IFRS compliant financial statements from your trial balance.

IAS 1 is the standard that tells you what financial statements should look like, and what the minimum requirements are for each primary statement. Primary statements of IFRS compliant financial statements are:

- Statement of financial position (Balance Sheet);

- Statement of profit or loss (P&L or Income Statement) and other comprehensive income (OCI);

- Statement of changes in equity; and

- Statement of cash flows.

IAS 1 will also tell you what to include in the notes to the financial statements, comprising accounting policies and other explanatory information. A complete set of financials should also include comparatives in relation to prior period (e.g. last year). P&L and OCI can be presented as either one set or two separate statements.

Many students and even professionals I know are for some reason scared of cash flow statement! Most don’t even know how to read it. What if I told you that you can prepare cash flow statement with very simple step-by-step guide? I will teach you how to read the cash flow statement, so you can impress your boss, teacher, auditor, your client or a friend? Click here to navigate to your step-by-step cash flow guide (coming soon).

First things first

Make sure you include the following in your financial statements, as many times as required (companies usually include these as a header to each page):

- Company name (and previously company name, if changed recently);

- Tell readers whether this is consolidated FS of a group, or standalone company financials;

- Accounting period covered; and

- The currency and the units or the level of rounding in which the numbers are presented.

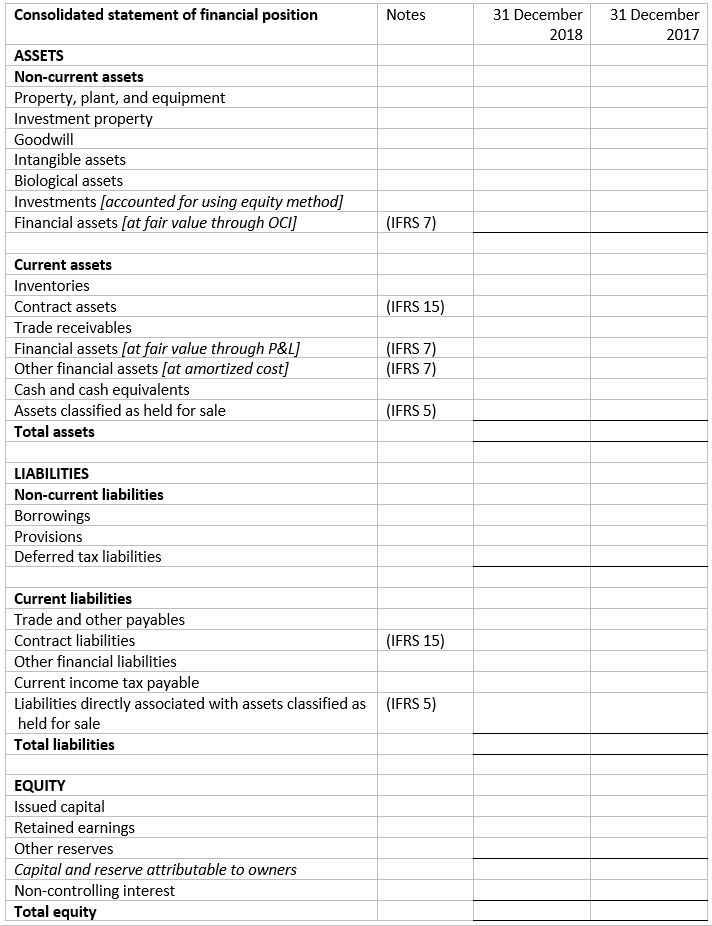

The BS requirements (by which I mean the balance sheet)

Make sure that you include these (as applicable) on the face of your balance sheet (IAS 1 paragraph 54,60):

The P&L

When you are presenting your P&L, make sure you classify your expenses consistently either by function or by nature (as required by IAS 1, paragraphs 100-103). Above P&L format distinguishes expenses by function.

- Expenses by nature: depreciation, purchases of materials, transport costs, marketing costs, etc.

- Expenses by function: cost of sales, distribution costs and administration costs.

Choose what is more relevant to your financials and do not mix expenses by function and nature.

Other comprehensive income (OCI)

OCI items should be classified by nature and grouped as follows:

- Items that may reclassified to P&L

- Items that will not be reclassified to P&L

Statement of changes in equity

This primary statement should basically show a reconciliation of each type of equity from opening balance to closing balance, something like the following:

Statement of cash flows

Many students and even professionals I know are for some reason scared of cash flow statement! Most don’t even know how to read it. Therefore, I decided to have a separate blog post especially for cash flows. Click here to navigate to your step-by-step cash flow guide (coming soon).

Notes and disclosures to IFRS Financial Statements

After 4 primary statements above, your financials should include notes comprising significant accounting policies and other information that may be relevant to understanding the financial information relating to your entity. I recommend that you follow the structure, similar to below:

- First, talk about your entity, its operations, segments and main activities, the geography in which it operates, the main laws and regulations affecting the entity, etc.

- Then, state whether these are consolidated group financial statements, and if so, list the subsidiaries, associates and identify their activities.

- A statement of compliance with IFRS is a must (IAS 1 paragraph 4.15), so state that your financial statements are prepared in accordance with IFRS as issued by the IASB. Also tell your readers that you have prepared the financials with the assumption that the entity is going concern (coming soon). Or else, describe any uncertainty about the entity being going concern.

- Give a summary of significant accounting policies. Start this with new and amended IFRS/IAS standards adopted by you during the year and how adoption of those affected your numbers.

- Tell your readers what your presentation and functional currencies (coming soon) are.

- Disclose information (usually done in table format, followed with some narrative) about components of each material item on your BS and P&L. For example, give breakup of your revenue streams, expenses, inventory, etc. To make everyone’s life easier, make sure you cross-reference information in the notes with numbers on the face of your BS and P&L.

- Disclose transactions and balances with related parties! See my blog who is related party? (coming soon).

- Disclose other information, not included on the face of your financials, such as contingencies and commitments, other uncertainties and off-balance sheet items and any significant non-financial information.

- Give some sensitivity analysis relating to financial risks affecting your entity and describe your financial risk management policy, as well as the process for managing capital. Financial risk would cover market risk, credit risk and liquidity risk. Market risk would include such risks as forex, interest rate and market price risk.

- Include any other information specific to your entity. Think of earnings-per-share (EPS) disclosures, discontinued operations, business combinations, offsetting financial instruments, assets pledged as security, and operating segments.

- And in the end, disclose any subsequent events (coming soon) affecting your entity.

If you need help preparing your IFRS financial statements from your trial balance (coming soon), then move on to my next post.

Below are useful links to illustrative financial statements, which you can get off the net:

Yours

JU